Since Russia’s unprovoked and unjustified invasion of Ukraine in February 2022, the Council has adopted eight packages of sanctions against Russia and Belarus. The sanctions aim at weakening Russia’s ability to finance the war and specifically target the political, military and economic elite responsible for the invasion.

The restrictive measures do not target Russian society. That is why areas such as food, agriculture, health and pharma are excluded from the imposed restrictive measures.

Estimates from diverse sources show that the restrictive measures taken in Europe and elsewhere against Russia are working as expected, and the results are visible through economic indicators.

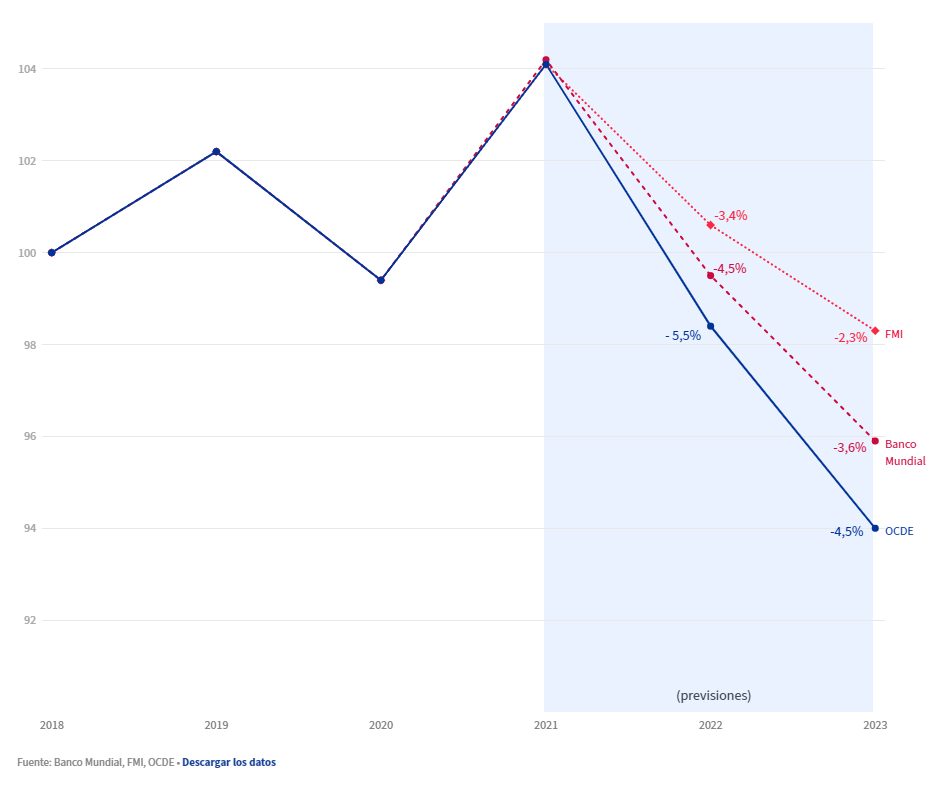

The Russian economy is shrinking

According to independent analysis by the World Bank, the International Monetary Fund (IMF) and the Organisation for Economic Cooperation and Development (OECD), 2022 is a bad year for the Russian economy. By the end of 2022, Russia’s gross domestic product (GDP) is expected to drop by at least 3.4% in the best-case scenario and by up to 4.5% in the worst-case scenario.

Russia’s economy will continue to shrink in 2023. Its GDP is forecast to decline by 2.3% year on year in the best-case scenario and by 5.6% in the worst-case scenario.

Russia’s GDP – evolution from 2018 to 2023

Chart showing Russia’s GDP growth year-on-year between 2018 and 2022 (forecast for 2022 and 2023) based on estimations from the OECD, the International Monetary Fund (IMF) and the World Bank.

The chart shows that, in 2022, Russian GDP will drop by 4.5% according to the World Bank, by 3.9% according to the OECD, and by 3.4% according to the IMF.

In 2023, Russian GDP is expected to drop by 5.6% according to the OECD, by 3.6% according to the World Bank and by 2.3% according to the IMF.

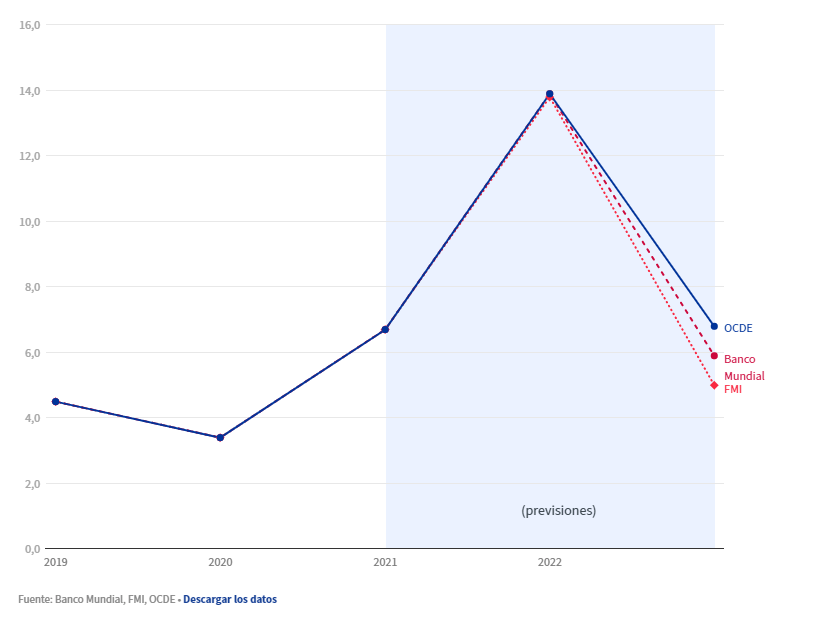

Declining trade, soaring inflation

The restrictive measures target the import and export of certain goods. The list of banned products is designed to maximise the negative impact of the sanctions on the Russian economy while limiting the consequences for EU businesses and citizens.

Figures are proving that these restrictive measures are yielding results. Both the World Bank and the IMF estimate that in 2022 Russian trade in goods and services is set to decline significantly. In 2023, exports will continue to decline while imports are expected to be higher than in 2022.

Russia’s imports and exports from 2018 to 2023

According to the IMF estimates, in 2022, Russia’s imports will drop by 19.2% (compared to 2021), while exports will drop by 15.98%. In 2023, imports will increase by 5.6% (compared to 2022), while exports will drop by over 3%.

According to the World Bank, Russia’s imports in 2022 will drop by 20.8% (compared to 2021) and exports will drop by 12.3%. In 2023, imports will increase by 3.3% (compared to 2022), while exports will drop by 9.1%.

Estimations show that Russia’s inflation rate will increase sharply by the end of 2022, reaching almost 14%. Forecasts for 2023 vary from 5% (IMF) to 6.8% (OECD).

Russia’s inflation developments from 2019 to 2023

Chart showing Russia’s inflation rate between 2019 and 2022, based on three estimations prepared by the World Bank, OECD and the International Monetary Fund (IMF). The inflation rate rises sharply in 2022, reaching almost 14% according to all three institutions. In 2023, the inflation rate will be 6.8% according to the OECD, 5.9% according to the World Bank, or 5% according to the IMF.

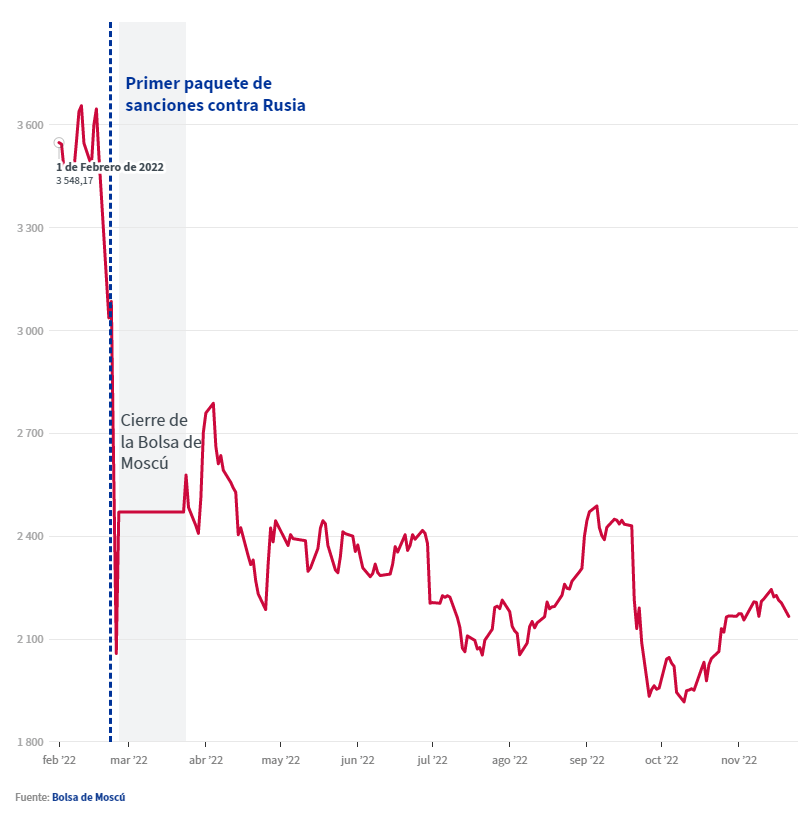

Consequences for the Russian capital market

The war and sanctions have also had a significant impact on Russian companies. Since February, Moscow Exchange’s main index has fallen by more than one third.

MOEX Russia Index

Chart of the MOEX Russia index – the main index of Moscow Exchange – between February 2022 and October 2022. The chart shows a steep drop in the index in mid-February (from over 3 600 points to less than 2 200 points. Between 25 February and 24 March, the stock exchange was closed (it closed at 2 470 points).

After reopening, the index rose to 2 800 points to then dropped again. In July and August 2022, it has been oscillating between 2 000 and 2 200 points. In the first half of September it reached 2400 points and after 19 September, it dropped to around 2000 points. In October and November the index is slowly growing to reach 2223 points on 15 November.

More information:

- EU response to Russia’s invasion of Ukraine (background information)

- Timeline – EU restrictive measures against Russia over Ukraine (background information)

- EU restrictive measures against Russia over Ukraine – since 2014 (background information)

- EU sanctions against Russia explained (background information)

- EU sanctions against Russia over Ukraine – since 2014 (infographic)

- EU sanctions in response to Russia’s invasion of Ukraine (infographic)

Leave a Reply